You may have heard of a tracker mortgage, but what exactly are they and how do they compare to the far more common fixed rate mortgage?

In this guide to trackers, we explain how they work and reveal the pros and cons you’ll need to weigh up if you’re thinking of moving to a tracker deal.

What are tracker mortgages and how do they work?

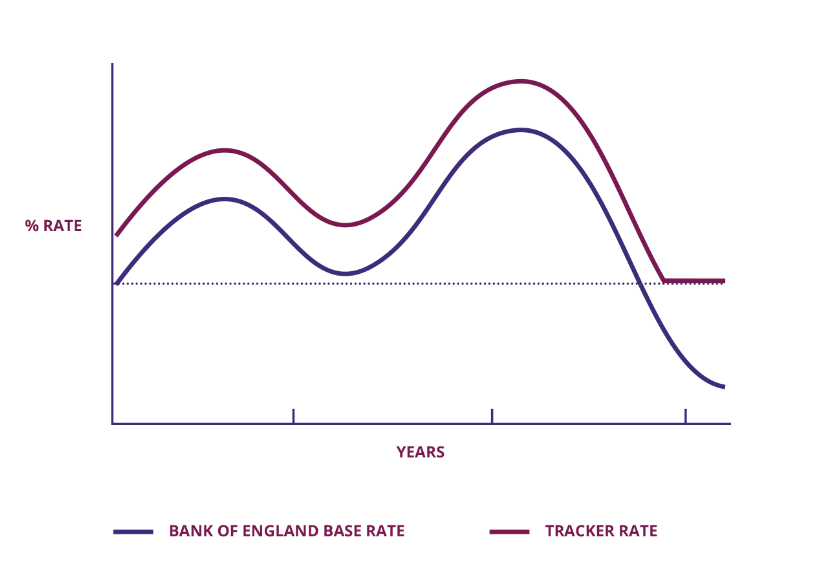

Tracker mortgages are a type of variable rate mortgage where the interest rate you pay can go up or down at any point during your deal.

Trackers are:

- Usually offered for between two and five years, but sometimes longer

- Tied to the Bank of England’s base rate for that period of time

- Are offered with an introductory interest rate set at a certain percentage above the base rate at that time

For example, a two-year tracker at +1% taken out when the base rate is 3% means you’ll pay 4% as an introductory interest rate on your mortgage.

However, if the base rate were to rise to 3.75% during your deal, your interest rate would also rise by 0.75% to 4.75%.

If the base rate were to fall by 0.75% to 2.25%, though, your rate would also fall to 3.25%.

Variable rate mortgages also include:

- Standard Variable Rate (SVR) mortgages

- Discounted rate mortgages

The main differences between other variable rate mortgages and trackers are:

- Standard Variable Rates (SVRs) are set by the lenders

- Discounted rate mortgages are discounted from the lender’s SVR rather than the Bank base rate, meaning they’re more likely to go up or down compared with a tracker

What are tracker mortgage collars and caps?

Tracker mortgages often come with ‘collars’ and sometimes ‘caps’.

A tracker collar is the lowest interest rate your deal can drop to, while a cap is the maximum rate it can rise to – both regardless of any changes in the Bank of England base rate.

For example, if your tracker has a collar of 2%, even if the Bank’s base rate falls sufficiently, your interest rate won’t fall below that figure.

Caps work the other way and are a maximum rate of interest you’ll pay even if the Bank rate rises.

Do tracker mortgages have early repayment charges?

Tracker mortgages often come with no early repayment charges (ERCs), meaning being on a tracker gives you more flexibility to move home or change your mortgage deal with no penalty.

The major benefit of having small or no ERCs is you may be able to switch to a fixed rate deal more easily if the Bank’s base rate starts to rise and your repayments go up.

What happens when my tracker mortgage ends?

Tracker mortgage deals are usually available for between two and five years, although longer deals including lifetime trackers are offered, too.

When your tracker deal comes to an end, your lender will move your mortgage on to their Standard Variable Rate (SVR).

This usually means your repayments will go up, so remortgaging on to another deal is often the best way to secure a more attractive rate once your tracker expires.

What’s the difference between a tracker and a fixed rate mortgage?

The biggest difference between a tracker and a fixed rate deal is tracker interest rates can go up or down, whereas fixed rate mortgage repayments stay the same.

Introductory tracker rates are usually cheaper than fixed rates because fixed rate mortgages offer more security.

However, if the Bank of England’s base rate rises substantially, tracker interest rates can rise quickly, too.

For example, if you were choosing between a 4.50% fixed rate or a +1% tracker when the base rate was at 3%, the tracker rate would be 0.5% lower than the fixed rate.

If the base rate were to rise by 0.75%, however, that tracker rate would overtake the fixed rate to become 4.75%.

Fixed rate mortgages, though, usually come with higher early repayment charges (ERCs) compared with trackers, meaning moving home or needing to switch mortgages during your deal can be extremely expensive.

More than six million UK homes are mortgaged on fixed rate deals, according to research – around 75% of all mortgaged UK homes.

There are more fixed rate products to choose from, too, with more than 1,400 available at the time of writing this piece.

That compared with 236 variable rate products, which include trackers.

What are the pros and cons of tracker mortgages?

Trackers come with a number of pros and cons you should consider…

| Tracker pros | Tracker cons |

| If the Bank of England base rate falls, your repayments will fall | If the Bank of England base rate goes up, your repayments will go up |

| Trackers often come with no early repayment charges (ERCs) | Trackers with interest rate caps are rare and come with higher introductory rates |

| Trackers with interest rate collars usually come with cheaper introductory rates | Trackers with introductory rate collars mean you’ll never benefit from rate falls |

Is a tracker mortgage right for me?

Tracker mortgages aren’t right for everyone, so you’ll need to carefully consider your personal circumstances before deciding.

While trackers can offer cheaper introductory rates compared with fixed rates and more flexibility to move or switch deals without penalties, base rate rises can mean higher repayments.